May 12, 2022

Lately, we’ve been trying to get inside the minds of our shoppers. We’ve been closely monitoring consumer behavior to understand how shoppers research brands and products and, ultimately, what drives their CPG purchasing decisions.

In recent years, we’ve seen that ‘convenience’ and ‘product benefits’ have replaced ‘brand name’ more and more as a driving decision factor. In fact, in our most recent survey — research of consumer packaged goods (CPG) in North America — we found that less than a tenth (only 8%) of respondents listed ‘brand name’ as an important attribute for new CPG purchases, so we were curious when doing the survey how shoppers were choosing their CPG products, and why.

CPG research key takeaways

The research of nearly 12,500 members of our Influenster community across North America explores the latest habits, attitudes, and sentiments for CPG products including food, beverages, baby products, pet products, household products, makeup, and skin care products.

What did we find?

1. Social responsibility: consumers are paying attention

We’ve seen a noticeable increase in consumers taking the environment into consideration when purchasing products across a variety of industries. We’ve seen glimpses of this in apparel, DIY & home, and we even just put together a whole piece on sustainability’s part in retail success. Clearly it’s an emerging trend.

And sustainability is a key factor when it comes to what CPG brands consumers will buy too. Here, though, it goes beyond just environmental issues and encompasses social and ethical issues as well. Of those we surveyed:

- 77% said it’s very/somewhat important for them that CPG brands source their products responsibly and ethically

- 76% said it’s very/somewhat important for them to see that CPG brands are taking initiatives to reduce their carbon footprint and embrace sustainability

- 75% said that it’s very/somewhat important for them that the packaging of the product is eco-friendly or recyclable

- 68% of respondents say that it’s very/somewhat important to them that the ingredients in the cleaning products they buy are natural and/or eco-friendly

As the above stats show, the majority of respondents state that being sustainable, recyclable and ethically-sourced are all key drivers when it comes to purchasing CPG products, which proves the environmentally-minded attitude of today’s consumers.

2. Ingredient labels are influencing purchase decisions

It’s not just what the product is, though, it’s what’s in the product that’s driving consumer purchasing decisions nowadays too. For example, 74% of our CPG research respondents who are parents said that it’s very/somewhat important to them that the ingredients in their baby food & drinks are natural and/or organic, while 81% said that it’s very/somewhat important to them that the ingredients in their baby body care products are ‘clean’ and/or ‘paraben free.’

Ingredient labels are, perhaps unsurprisingly, especially considered when it comes to purchasing food products:

- 56% said that it’s very/somewhat important to them that the ingredients they use for cooking and baking are organic

- 48% said that it’s very/somewhat important to them that the ingredients they use for cooking and baking are gluten-free

- 44% of consumers say that it’s very/somewhat important to them that the ingredients they use for cooking and baking are plant based

This partly ties in to the environmental attitude of today’s consumers, as plant-based and organic tend to be greener, but on top of that it shows that consumers really care about their own health as much as the planet’s health.

In fact, 67% of the surveyed consumers want to see recipes from brands for cooking or baking that show alternatives, such as gluten free and organic products. This tells us that consumers are research dietary needs and health benefits when it comes to purchasing CPG products.

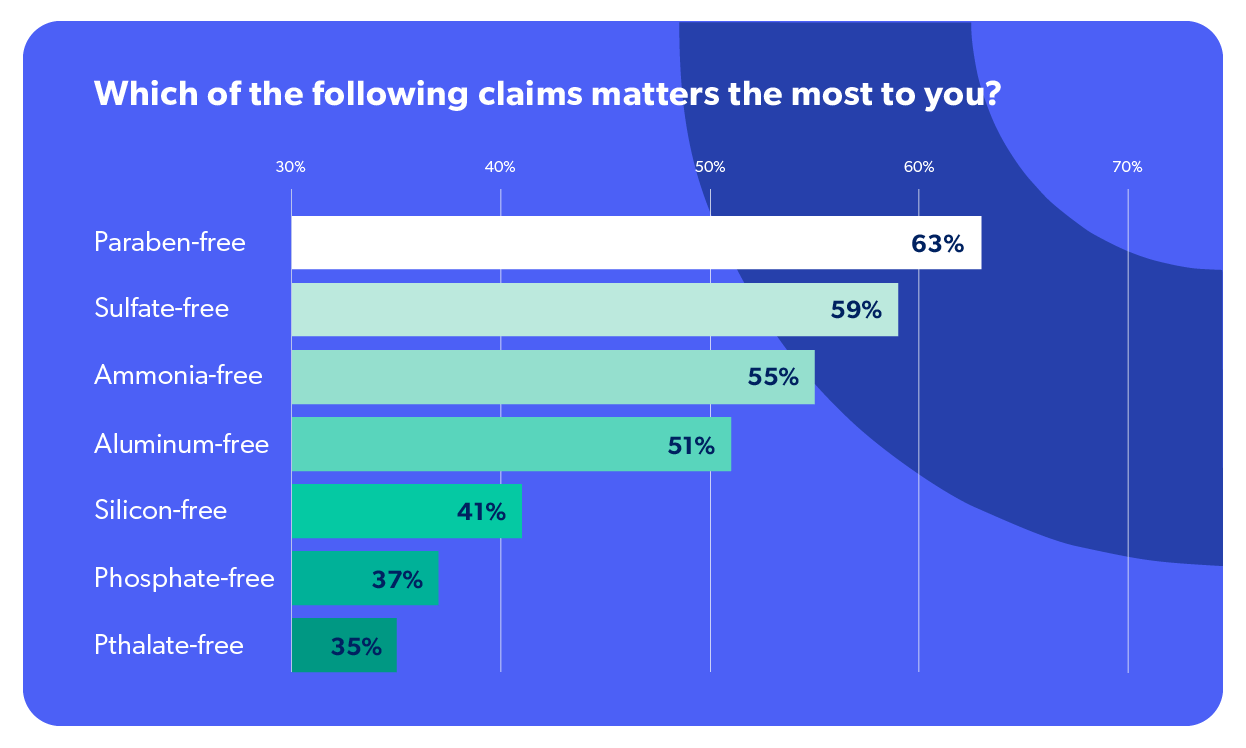

Consumers also care as much about their external health as they do their inner health, as the following table shows. We asked our members what they look for when it comes to choosing skin/hair care products & cosmetics, and here’s what they said:

The responses from our community members clearly show that the majority look to avoid products like parabens and sulphates, which have long been considered to be harmful for the skin/hair.

3. Are consumers still shopping?

Yes, they are. But what are they buying, and when?

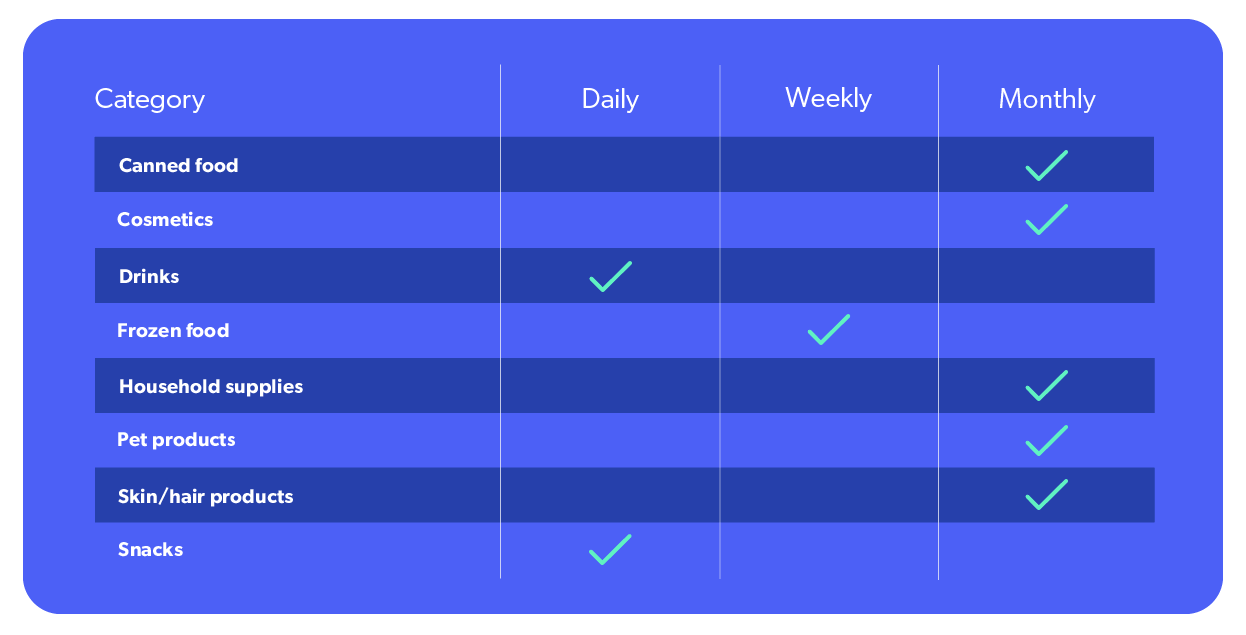

- Consumers are more likely to purchase snacks & drinks – daily

- Consumers are more likely to purchase frozen food – weekly

- Consumers are more likely to purchase canned food, household products, pet products, skin/hair care products and cosmetics – monthly

A full breakdown of how frequently consumers are buying specific products looks like this:

There’s no surprises here really. Low-cost products intended for instant consumption, like snacks, tend to be bought daily. Whereas your pricier products, and those with longer shelf lives like cosmetics, are bought monthly. But the real question is where are consumers purchasing these products?

4. In-store vs online

Somewhat surprising, given the change in consumer buying habits, but in-store shopping is still the go-to when it comes to purchasing CPG products. While shoppers still research online, a huge 82% of the surveyed respondents said they prefer buying CPG products in-store at retailers (Target, Walmart), while 49% prefer buying online via retailers (Target, Walmart) and another 58% prefer buying online from Amazon.

The results are slightly different when it comes to groceries specifically. 72% of those surveyed prefer buying groceries in-store at local grocery stores (Kroger, Stop & Shop) and 59% buy in-store at retailers (Target, Walmart), while only 30% of consumers prefer buying at retailers online.

The results swing much more toward in-store groceries, likely because people like to see/hold the produce they’re buying, and not to mention they were one of the few types of store kept open during lockdowns.

Speaking of in-store purchasing, 66% of consumers are more likely to try a new product from shopping in-store (vs. only 34% who said online) which leads on to the final main takeaway from the survey.

5. What influences a consumer’s decision to try a NEW product?

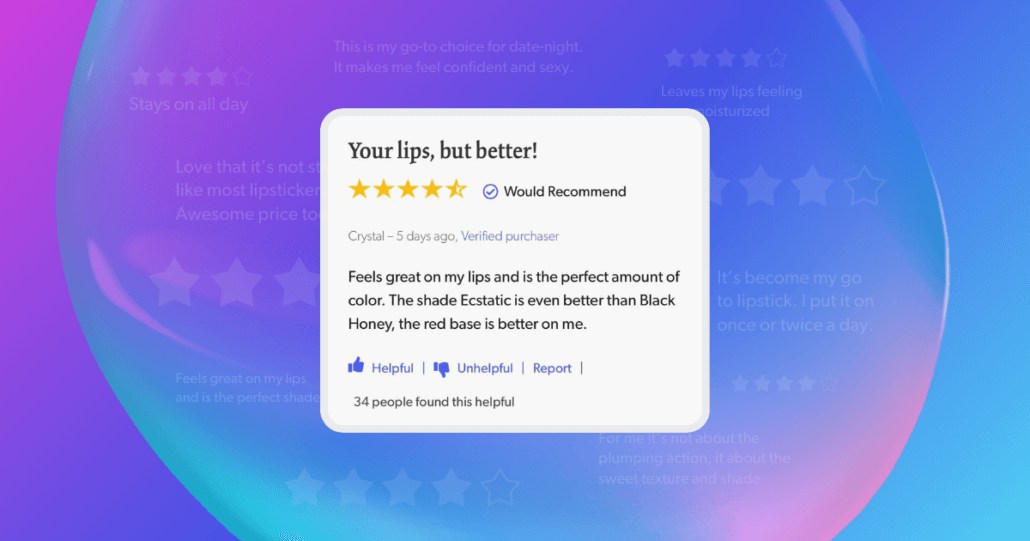

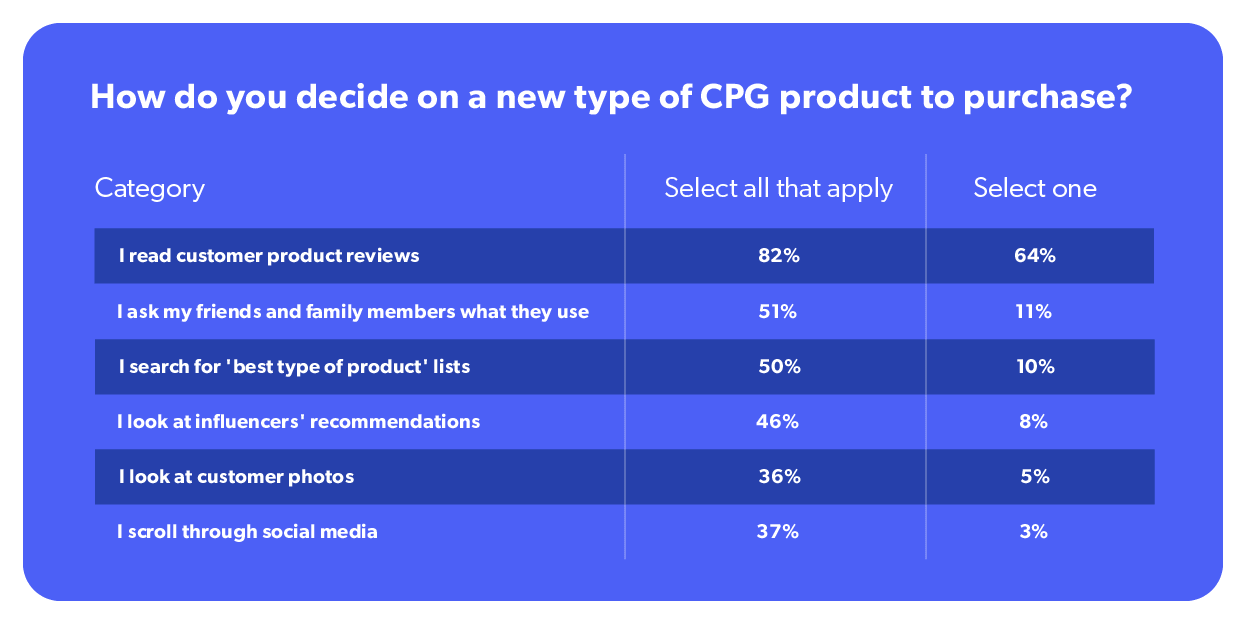

We already know that reviews matter (particularly the recency of reviews.) Our own research has told us this. But do they matter when it comes to purchasing CPG goods? Yes, they do. When researching a new CPG product, the top three drivers for purchase are product reviews (82%) followed by family & friend recommendations (51%) then ‘best types of products’ lists (50%).

But when asked to select only one driver, the vast majority (64%) said they read customer reviews, as the following table shows:

Reviews on social media specifically also play a large part, with 83% of respondents saying they’re very/somewhat likely to purchase a new product advertised on social media with photos and reviews from other shoppers. Another 82% would share their honest opinion about a new product by writing a review and posting on social media.

Turn CPG market research into actionable results

As our CPG market research shows, there’s multiple attitudes and habits that consumers take into account when it comes to making CPG purchasing decisions. And clearly ‘brand name’ isn’t one of them. But if you’re wondering how your retail brand can win over these consumers, the trends are easy to spot.

Make sure your brand is socially responsible, your products are friendly to both people and the planet (and clearly labelled so), and that you utilize customer ratings and reviews for other potential consumers to use, and you’ll have consumers won over in no time at all.

For more research, marketing strategies, and ways to stand out on the digital shelf, see our CPG industry page.